From Chief Investment Officer Tom Veale,

“Upward pressure on stock market risk continues to build this week as we watch the SignalPoint Market Risk Indicator (MRI) move up another two points to 31. All four MRI components rose with two still being bearish (Relative Valuation and Speculation) while two are neutral. This combination puts the MRI Oscillator value at +10 indicating significant upward risk pressure.”

“While the MRI is still in its Neutral range it is starting to crowd its bearish delineation. The Speculation Index should start to correct toward its neutral range and median value over the next six weeks even if the markets remain where they are currently. The Relative Valuation Index remains sensitive to the current Quarter’s earnings reporting and inflation pressure even as the FED contemplates no near term change to interest rates.

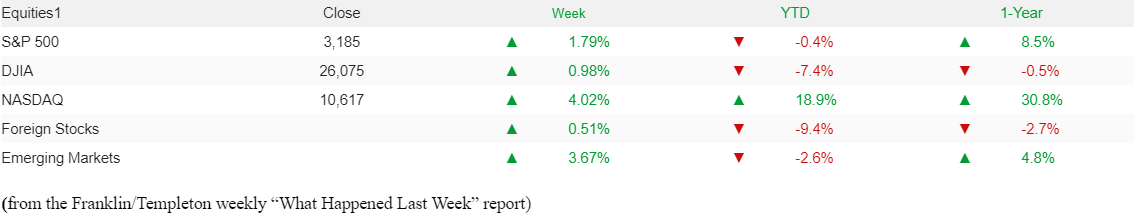

The NASDAQ Composite Index is out-distancing its other cap weighted indexes with new record highs nearly on a daily basis.”

“Both the year-to-date and year over year comparisons are heavily influenced by a very small number of company stocks listed on the NASDAQ.”

The Market Risk Indicator is an assessment tool that serves as a guide through all markets as to the prudent use of a liquid cash cushion. It helps determine an approximation of the amount of cash reserve relative to a diversified equity portfolio. (this is depicted by the graph above)

At times of high risk in the market, the MRI will suggest a higher level of cash reserve. At times of low market risk, the MRI will suggest a lower level of cash reserve. This investment process helps to measure and manage market risk.

Because of this, the fear associated with the uncertainty of the market can be replaced by the security of a sound investment strategy.