From Chief Investment Officer Tom Veale,

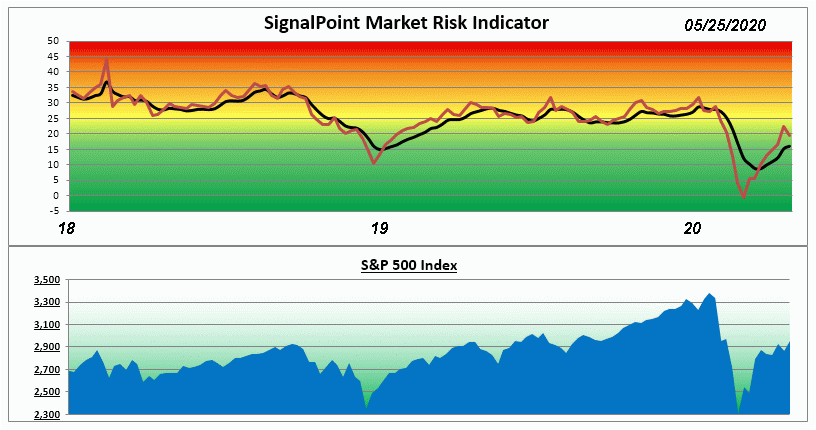

“Overall risk as indicated by the SignalPoint Market Risk Indicator (MRI) is rising back toward its neutral range. It is up one point to 16 this week. Two components this week show bullish signals (Speculation and Divergence indexes) while two are neutral. The MRI Oscillator shows +5 indicating rising risk pressure overall. We are now in Week 10 of bullish MRI signals.”

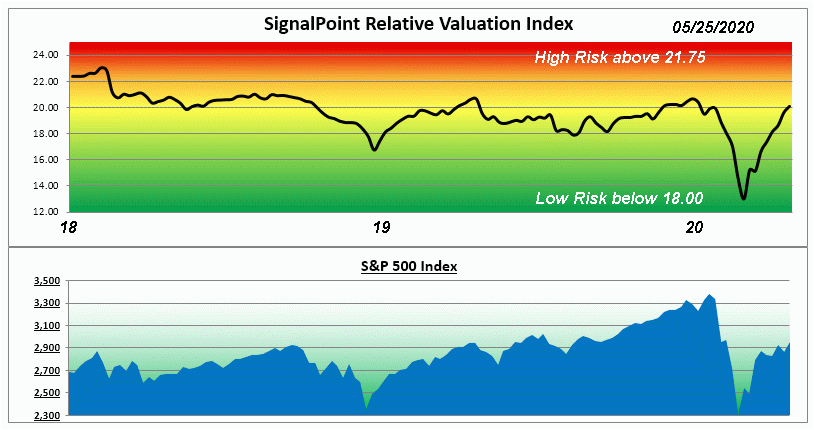

”If we view the Relative Valuation Index component we see it has now returned to where it was prior to the influence of the C-19 virus and is neutrally ranked (near median value).”

“Currently there is room for the Value Line median P/E to rise to 19.8 (from 18.1) before the Relative Valuation Index would become bearish. A rise in short term interest rates from their very low level could also push the index into bearish territory. Since forward looking P/Es are currently guesswork we’ll await Q2 and Q3 reporting to see what they show.”

The Market Risk Indicator is an assessment tool that serves as a guide through all markets as to the prudent use of a liquid cash cushion. It helps determine an approximation of the amount of cash reserve relative to a diversified equity portfolio. (this is depicted by the graph above)

At times of high risk in the market, the MRI will suggest a higher level of cash reserve. At times of low market risk, the MRI will suggest a lower level of cash reserve. This investment process helps to measure and manage market risk.

Because of this, the fear associated with the uncertainty of the market can be replaced by the security of a sound investment strategy.